While trading firms are increasingly keen to embrace cloud technology for the implementation of software solutions owing to the many advantages it offers in hosting and managing applications, it is crucial to understand that there are several new and often complex technologies involved. In this blog post, we will explore the benefits of Amazon Web Services (AWS), its key services and how Sinara can develop, deploy and support trading systems for the cloud based on our SinaraTLC framework.

AWS is a cloud computing platform that provides a suite of computing and storage services designed to enable organisations of all sizes and types to scale and innovate their applications and businesses. AWS provides its services in multiple global regions and availability zones, ensuring that applications and data remain available even in the event of an outage. Security features and services, such as firewalls, virtual private networks, and identity and access management help keep applications and data secure.

It’s important to note that developing a trading platform with cloud infrastructure such as this in mind requires a different approach than developing a traditional on-premises application. SinaraTLC is a suite of software components for processes across the trading lifecycle, designed from the ground-up with a cloud-first approach. This framework allows us to rapidly develop new systems for trading operations from placing an order, risk management, and matching, through to clearing and custody.

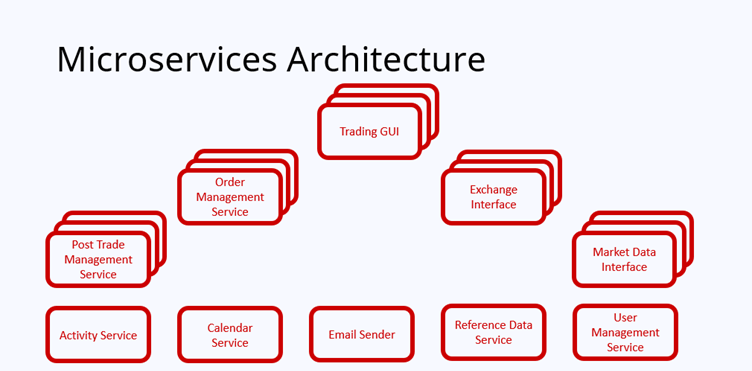

SinaraTLC adopts a microservices architecture which is a software design pattern that structures an application as a collection of small, independent services that communicate with each other through APIs. Each microservice has a well-defined responsibility and can be developed, deployed, and scaled independently.

SinaraTLC’s approach sets it up very well for deploying to AWS, allowing us to deliver client-specific implementations that are high-speed and scalable with back-ends and web-based GUIs offering rich functionality that can be used by both financial firms and their customers.

AWS has a number of key services for automatically managing application instances and resources. At Sinara we may employ a subset of these to run a SinaraTLC-based solution.

- EC2 (Elastic Compute Cloud): EC2 is a web service that provides resizable compute capacity in the cloud. EC2 instances c7an be launched in various configurations, such as virtual machines (VMs), containers or serverless computing. This means that trading platforms can scale up or down their computing resources depending on demand. This can be especially useful during high traffic periods or when there is a sudden surge in demand, for instance, for a particular security.

- S3 (Simple Storage Service): S3 is an object storage service that provides scalable and secure storage for any type of data. It can be used to store trading data, such as historical market data or user account information. S3 can also be used to store backups of the trading platform, ensuring that critical data is always protected.

- RDS (Relational Database Service): RDS is a managed relational database service that supports popular databases such as MySQL, PostgreSQL, and more. It provides automated backups, software patching, and maintenance of the database, allowing developers to focus on building their trading application instead of managing the database.

- Lambda: Lambda is a serverless computing platform that runs code in response to specific events, such as an HTTP request or a change in a database. It can be used to perform functions such as processing market data, running algorithms, or sending notifications to users.

- IAM (Identity and Access Management): IAM is a service that provides secure access to AWS resources, such as EC2 instances, S3 buckets, and more.

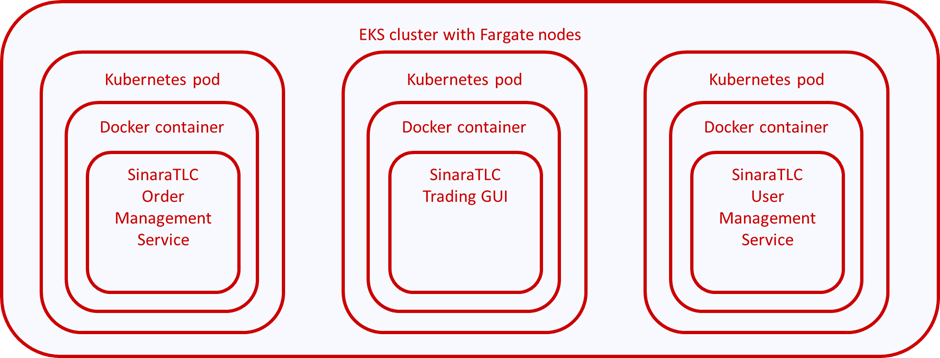

To deploy the SinaraTLC-based solution onto the above AWS infrastructure, a series of tools are used. The key technology underpinning any TLC deployment on AWS is Docker. This is a containerisation technology that enables the creation and use of applications based on containers, which can be thought of as small, reusable, portable, independent units of software.

Containerisation is an approach to running applications such that the application is isolated from the rest of the system and Docker is the platform which enables us to run, create and manage containers on a single operating system host.

In turn, Kubernetes is an orchestration tool used for managing and automating containers in terms of:

- Managing the lifetime – restarting if they crash, creating duplicates

- Managing communication – providing a scalable internal networking model for multi-component projects

- Managing resources – efficiently distributing containers across physical hardware

For a more thorough overview of Kubernetes, please feel free to read our technical blog post: Introduction to Kubernetes (K8s) – Sinara Consultants

Further management and hosting technologies including Helm, EKS, Fargate and Terraform all assist in reducing the overhead of manually managing a multi-component system and intelligently directing the requisite compute resources for the system to run optimally.

At Sinara, our dedicated support teams and expert developers take on the full implementation of these complex deployments and offer ongoing support and management of our client TLC deployments, ensuring that they are configured correctly and running optimally.

As the modular architecture of SinaraTLC naturally lends itself to the possibility of further enhancements and modifications, our clients can quickly add new system functionality and scale-up capacity by adding more instances of microservices.

In conclusion, with its wide range of services, high availability, and security services, AWS is a popular choice for organisations that are looking to move to the cloud. By adopting a microservices architecture for SinaraTLC, we can build and deliver sophisticated trading operational systems into AWS faster, with improved scalability and resilience. Functionality separated out into containers can be added and removed with ease, allowing a full-scale system to be developed over time with new features being added as required. Our skilled teams take care of the technical complexities, leaving our clients to focus on their trading activities, making the most of their technology investment.